Full Spectrum Financial Group Takes You Behind the Scenes of Developing a Financial Plan

By Steve Griffin, CFP® and Kelly Goldstein, CFP®

Do you know all the variables that go into a comprehensive financial plan? When financial advisors from our team at Full Spectrum Financial Group design a financial plan, they cover all facets of our clients’ lives with a focus on their values, goals, and dreams. We are proud of the scope of our data-gathering process, the breadth and depth of what we include in the financial plan itself, and our focus on planning first and creation/implementation second.

Providing a sample financial plan along with a step-by-step description of the discovery and analysis process we used to create it, this article illustrates how we construct a financial plan in its entirety. For the purposes of this article, we’ll use fictitious clients, Frank and Joanna Miller. Mr. and Mrs. Miller are a good example for this article because of their strong cash flow, balance sheet, and uncertainty about how to use their resources to optimize their financial future.

Initial Meeting

It all starts with an initial meeting. We begin with understanding what our clients are hoping to accomplish. When determining whether we’ll be creating a financial plan for them, clients are typically looking for clarity on several concerns, including whether they can retire at the age they want, what age they should claim Social Security, and if they’re being tax-smart in their savings plan.

Essentially, the initial meeting’s goal is to determine how much value we can contribute and to gauge whether the client is motivated to work with us.

Discovery

Once the Millers decide to move forward, we begin the discovery phase. During this key step in our process, we dive deep into understanding the Millers’ finances from both a quantitative and qualitative perspective. We weigh these considerations equally because their values, goals, and objectives are just as important to us as crunching the numbers.

The more we understand what’s most important to clients like the Millers, the better we can customize their financial plan. When it comes to the numbers, we’re meticulously thorough in the collection and review of the financial data, including assets, liabilities, income, expenses, tax returns, legal documents, etc. In short, we leave no stone unturned in discovering where the client is and where they want to go.

Analysis and Design

Armed with a solid understanding of the Millers’ goals, concerns, and current financial landscape, we then get down to the crux of the planning process: the analysis and design phase.

We first project their current plan over their lifetime in what we call their “base facts.” This shows us how well they would be positioned if they didn’t make any changes to their current plan. It also shows us what would happen if no major financial events occurred.

We use this analysis as a guide to determine what changes, if any, should be made to improve their plan to create financial longevity. We think stress testing financial plans is a critical step, yet it’s an often-overlooked practice in the industry.

So we model events like:

Bear market during client’s planned retirement

Premature deaths

Increased taxes and inflation

Unexpected healthcare expenses

Sample Financial Plan

Below, take a look at the sample financial plan we created for our fictitious clients, the Millers. You’ll notice that each page of the Millers’ plan incorporates information we gathered during our thorough discovery and analysis process.

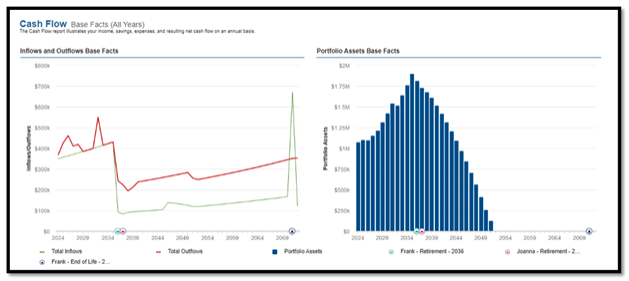

Figure 1: Cash Flow

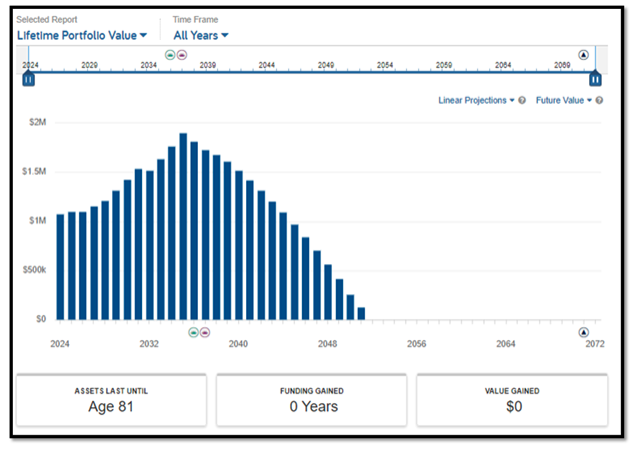

Figure 2: Lifetime Portfolio Value

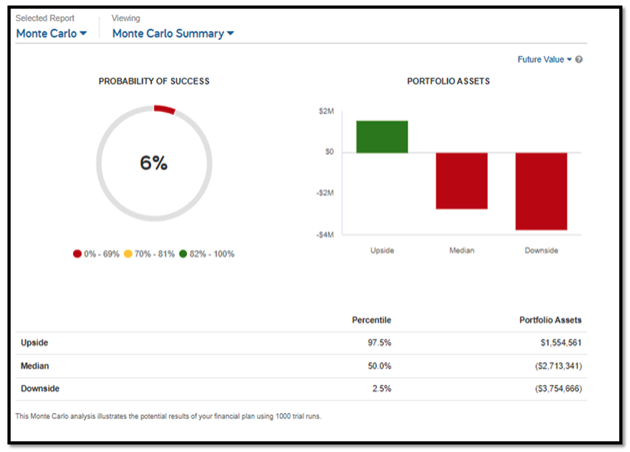

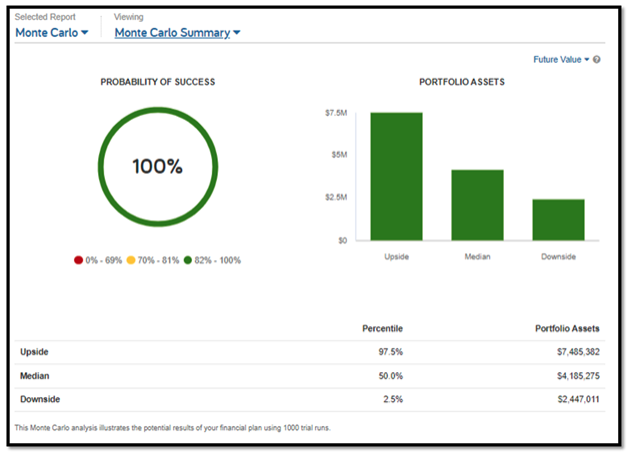

Figure 3: Monte Carlo Summary

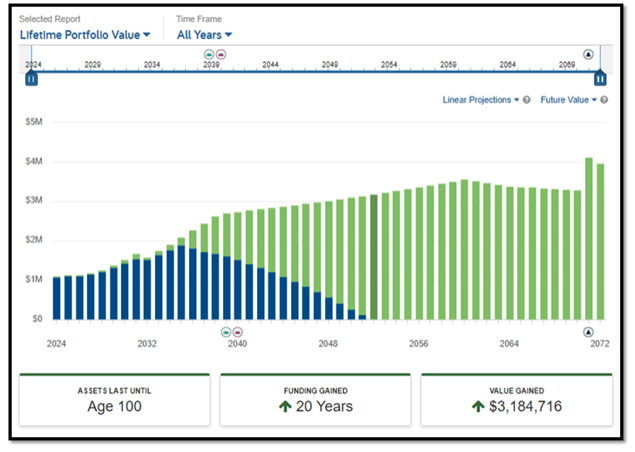

Figure 4: Modified Lifetime Portfolio Value

Figure 5: Modified Monte Carlo Summary

Delivery

Once the analysis phase is complete, areas for improvement identified, and the plan finished, it’s time to deliver the plan to Frank and Joanna. Some action items might need to be implemented right away; others may take months or even years to accomplish.

We believe it’s crucial to continually monitor, review, and update the plan. It doesn’t do any good to put the plan in a drawer and ignore it. Even if the Millers only implement some of the action items we suggest, their lives can undoubtedly improve. Our goal is to meet with clients like the Millers at least once a year following plan delivery to verify they’re on track to pursue their goals.

Get Started

At Full Spectrum Financial Group, our goal is to guide you toward the future you want! The financial plans we develop compile the information you give us into an all-inclusive blueprint. That blueprint gives you the tactics and guidelines you need to confidently pursue all your financial goals.

Once you’ve had a chance to review this sample financial plan, reach out to us by calling (941) 866-6570 or emailing info@fullspectrumfinancialgroup.com.

ABOUT STEVE

Steve Griffin, CFP® is Principal and Founder at Full Spectrum Financial Group, a financial services firm based in Sarasota, Florida, offering innovative strategies to help clients develop a personalized plan that meets their needs for today and tomorrow. With over 20 years of financial planning experience, Steve creates custom, actionable solutions for his clients’ most complex challenges. From managing a family’s personal wealth to helping business owners focus on their big picture, he finds great fulfillment in empowering clients to make forward-focused decisions and feel more confident in their ability to reach their goals. Listening closely and taking an educated, unbiased approach, he’s able to bring organization and direction to clients’ financial lives.

Steve holds a degree in finance from the University of South Florida. Steve is held to some of the industry’s strictest standards of ethics and education as a CERTIFIED FINANCIAL PLANNER® (CFP®) professional. He’s actively involved in several prominent industry organizations, including National Association of Insurance and Financial Advisors (NAIFA), The Financial Planning Association, The Southwest Florida Estate Planning Council, and The Million Dollar Round Table (MDRT), which is the Premier Association of Financial Professionals and recognized globally as the standard of excellence for life insurance sales performance in the insurance and financial services industry.

Residing in Sarasota, Florida, Steve and his wife, Trish, enjoy the area’s great restaurants and world-class beaches. Outside of the office, Steve can be found golfing, watching sports, spending time with his daughters, and cheering on his grandkids at their events. With a great appreciation for the healing power of laughter, Steve enjoys watching funny movies or stand-up comedy. He also prioritizes his faith by volunteering at his church and reading Scripture daily. Connect with Steve on LinkedIn or via email at steve@fullspectrumfinancialgroup.com.

ABOUT KELLY

Kelly Goldstein, CFP® is a Financial Planner and Wealth Advisor at Full Spectrum Financial Group, a financial services firm based in Sarasota, Florida, offering innovative strategies to help clients develop a personalized plan that meets their needs for today and tomorrow. With a passion for building strategic, holistic plans, Kelly provides clients with clarity, simplifying even the most complex subjects. She enjoys getting to know clients on a personal level and seeing the impact small decisions can make on a client’s financial well-being and progress toward their long-term goals.

Kelly holds a bachelor’s degree from University of Central Florida and an MBA from Saint Leo University. Prior to becoming a financial advisor in 2017, she taught as an adjunct professor for business and marketing courses at Saint Leo University and worked as the office manager and para-planner for her father’s firm. In pursuit of her ongoing commitment to education and self-improvement, Kelly has earned her CERTIFIED FINANCIAL PLANNER® (CFP®) designation, and is currently enrolled to earn her Chartered Financial Consultant® designation.

In her free time, Kelly and her husband, Joe, enjoy golfing, traveling, spending time at the beach, and attending Tampa Bay Lightning hockey games. She is also involved in several industry and community organizations, including the Million Dollar Round Table (MDRT), the Lakewood Ranch Business Association (LWRBA), the Sarasota Chamber of Commerce, and the Sarasota-Manatee Human Resource Association. Connect with Kelly on LinkedIn or via email at kelly@fullspectrumfinancialgroup.com.

Steve Griffin and Kelly Goldstein are Financial Advisers offering Investment Advisory Services through Eagle Strategies LLC a Registered Investment Adviser and Registered Reps offering securities through NYLIFE Securities LLC FINRA/SIPC, a Licensed Insurance Agency. They are licensed to sell insurance through New York Life Insurance Company and may be licensed with various other independent unaffiliated insurance companies not in all jurisdictions.

Neither Full Spectrum Financial Group, nor NYL, nor its agents, provide tax, legal, or accounting advice. Please consult your own tax, legal, or accounting professionals before making any decisions. Full Spectrum Financial Group is not owned or operated by NYLIC or its affiliates.

OUR LOCATION

306 N Rhodes Ave Suite 110

Sarasota, FL 34237

-1758044038163.jpg)